We are excited to announce that you will soon benefit from the new Empower Personalized Experience at www.dap401k.com. Whether using the website or mobile apps, you will be able to your complete financial picture in an innovative and actionable way.

The process of moving over to the new experience will happen throughout the day next Wednesday, May 4th; however, you will never be without access to your accounts online or the ability to complete transactions. The website address (URL)/mobile apps and all user IDs and passwords will remain the same.

If you are enrolled in My Total Retirement (MTR)- Financial Advisory Services

On the day of migration, May 4th, access to My Total Retirement may not be available.

There will be approximately 1.5 hours at the beginning of the migration that the call center won’t be able to assist you with opting in/opting out of MTR.

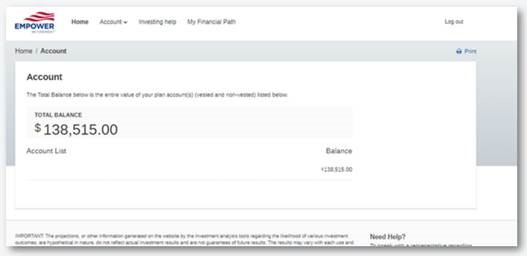

The Account Overview dashboard when you log in before the change.

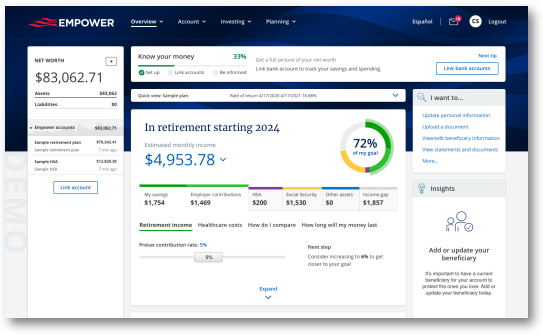

When the move is complete, here is the new Account Overview dashboard with the new look and feel.

If you have questions or concerns, please call Michelle in the DAP Office at 314-739-7373